Housing Allowance

Area: Design, planning and building

Housing allowance is a financial housing policy measure, mostly aimed at making rental housing more affordable for both individuals and households (Bengtsson, 2006; Bežovan, 2010; Haffner & Boelhouwer, 2006; Ytrehus, 2015). It is often means-tested and forms part of the welfare scheme. While the primary beneficiaries are renters, there are cases where homeowners may also be eligible for housing allowances. The primary goal is to ensure that majority of the population can access housing at prices within their means (Kemp, 2000).

In the realm of housing subsidies, two primary categories exist: demand-side and supply-side subsidies.

Housing allowances are categorized as demand-side subsidies, which means they benefit the receivers of housing services, such as renters, who have some control over the subsidy and the right to choose their housing units (King, 2016). On the other hand, supply-side subsidies target land developers and construction companies, and recipients have no control over the subsidy. Over time, there has been a shift from supply-side to demand-side subsidies, particularly during the 1970s and 1980s, resulting in means-tested subsidies that were "person-based" rather than "object-based" (Haffner & Boelhouwer, 2006; King, 2016) These changes contributed to reducing housing prices, especially rents.

However, concerns arose in the 1990s, with critics contending that means-tested subsidies introduced work disincentives (Bozio et al. 2017), discouraging people from entering the labour market and potentially leading to increased poverty. Another identified risk was the potential for housing over-consumption due to mass subsidies. Despite these criticisms, housing allowances play a crucial role in providing income support during both transitory and long-term periods of poverty. They help to mitigate risks associated with housing expenditure during income interruptions caused by factors such as unemployment or illness (Griggs & Kemp, 2012).

The impact of housing allowances on households’ disposable incomes is significant and serves an important income support function. It distinguishes between ensuring the affordability of adequate accommodation and having enough budget left for non-housing expenses. The growing need for income support through housing allowances arises from emerging social risks, including factors such as lone parenthood, precarious work, long-term unemployment, mental health, and working poverty (Griggs & Kemp, 2012).

The relationship between housing allowances and the impact on rising rent levels is a central debate in the literature (Eerola & Lyytikäinen, 2021; Eriksen & Ross, 2015; Hyslop & Rea, 2019; Susin, 2002). Some of these studies suggest that the introduction of housing allowances can lead to an increase in rents within the private rental market, while others do not provide conclusive results. However, the influence of housing allowances on housing prices appears to be intricate, exhibiting variations across countries and time periods, making it a complex and multi-faceted issue (Eerola & Lyytikäinen, 2021; Hyslop & Rea, 2019).

Housing allowances come in various forms, including means-tested, income-related, and quota-based, with payments made directly to tenants or landlords (Hyslop & Rea, 2019). The same authors note that there was a slight increase in rents when housing allowance was introduced. However, it is not clear whether this was due to increased demand for rental housing, to which landlords responded by raising prices, or whether recipients spent more on better quality (or quantity) housing. The authors state that two-thirds of recipients benefited from higher disposable income after deducting housing costs in that study.

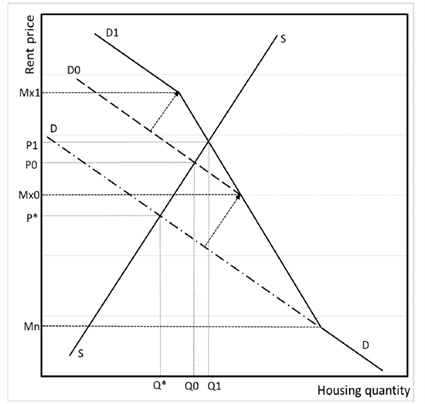

From a theoretical standpoint, the neoclassical market model serves as a valuable framework for predicting a possible uptick in rental prices through the introduction of housing allowances. These grants make recipients less sensitive to rent increases, and if the supply is not perfectly inelastic (i.e. the quantity supplied of the good remains the same regardless of price changes), the increased demand will shift the demand curve upward (D > D0 > D1). Consequently, the new price equilibrium will rise (P* > P0 > P1), accompanied by only a small increase in the quantity of housing supplied (Q* > Q0 > Q1). This change is shown in Figure 1.

Figure 1. Theoretical representation of the rent price increase due to housing allowance introduction. Source: Hyslop & Rea (2019)

According to Hyslop & Rea (2019) “a major concern with an increase in housing subsidy is that the intended welfare gains for recipients will be eroded by an increase in rents, with landlords capturing a substantial fraction of the benefits of the subsidy.” Despite this concern, the provision of housing allowances for the lowest-income households could enable them to escape from substandard housing, offering a pathway to potentially alleviate issues related to homelessness and overcrowding (Hyslop & Rea, 2019).

In post-socialist countries, housing allowances gained prominence after regime changes and the transition from rent regulation regimes. However, their role was relatively minor compared to other policies, such as the right-to-buy policy (Bežovan, 2010; Hegedüs, 2013; Lux & Puzanov, 2013). The distribution of housing allowances varied significantly among these countries, with Russia and Hungary having higher percentages of households receiving allowances (Lux & Puzanov, 2013). The finances for these programmes typically come from state or municipal budgets. An issue with housing allowance programmes in these countries is that they do not consider national differences in living costs, leading to unequal assistance for households in less expensive areas compared to those in more costly regions. Another issue lies in the grey economy; renting without a contract between the landlord and the tenant prevents the application and eligibility for receiving allowances.

Housing allowances play a pivotal role in both welfare and housing policy, with a dual aim of enhancing housing affordability and offering income support to individuals and households. Nonetheless, their impact on rent levels remains a subject of debate, and their effectiveness exhibits variations across different countries and contexts.

References

Bežovan, G. (2010). Analysis of the rent subsidy system and housing costs, and the practice of building social housing in Croatia. [Analiza sustava subvencioniranja najamnina i troškova stanovanja te prakse gradnje socijalnih stanova u Hrvatskoj], Hrvatska i komparativna javna uprava : časopis za teoriju i praksu javne uprave, Vol. 10 No. 3, 2010

Bozio, A., Guillot, M., Monnet, M. & Romanello, L. (2017). Designing housing benefits: An application with French data. Économie & prévision, 211-212, 163-175. https://www.cairn-int.info/journal--2017-2-page-163.htm.

Eerola, E. & Lyytikäinen, T. (2021). Housing Allowance and Rents: Evidence from a Stepwise Subsidy Scheme. Scand. J. of Economics, 123: 84-109. https://doi.org/10.1111/sjoe.12396

Eriksen, M. D. & Ross, A. (2015). Housing Vouchers and the Price of Rental Housing, American Economic Journal: Economic Policy 7, 154–176.

Griggs, J. & Kemp, P. A. (2012). Housing Allowances as Income Support: Comparing European Welfare Regimes, International Journal of Housing Policy, Vol. 12, No. 4, 391–412

Haffner, M. & Boelhouwer, P. (2006). Housing Allowances and Economic Efficiency. International Journal of Urban and Regional Research, DOI:10.1111/j.1468-2427.2006.00699.x

Hegedüs, J. (2013). The Transformation of the Social Housing Sector in Eastern Europe - A Conceptual Framework. In Hegedüs, J., Lux, M. & Teller, N. (Eds.) Social Housing in Transition Countries (pp. 3-33). London: Routledge. ISBN 9781138809567

Hyslop, D. R. & Rea, D. (2019). Do housing allowances increase rents? Evidence from a discrete policy change, Journal of Housing Economics, Volume 46, December 2019, 101657 https://doi.org/10.1016/j.jhe.2019.101657

Kemp, P. A. (2000). The Role and Design of Income-Related Housing Allowances. International Social Security Review, 53: 43-57. https://doi.org/10.1111/1468-246X.00077

King, P. (2016). The principles of housing. Routledge. https://doi.org/10.4324/9781315674988

Lux, M. & Puzanov, A. (2013). Rent Regulation and Housing Allowances. In Hegedüs, J., Lux, M. & Teller, N. (Eds.) Social Housing in Transition Countries (pp. 65-81). London: Routledge. ISBN 9781138809567

Susin, S. (2002). Rent vouchers and the price of low-income housing, Journal of Public Economics, 83, 109–152.

Ytrehus, S. (2015). The Role of the Housing Allowance for the Elderly in Norway: Views of Recipients Journal of Housing for the Elderly, 29: 164–179

Created on 13-12-2023 | Update on 23-10-2024

Related definitions

Affordability

Area: Policy and financing

Created on 27-08-2021 | Update on 20-04-2023

Read more ->Related cases

No entries

Related publications

No entries